Sales Tax and TicketSignup

TicketSignup takes care of all the obligations of calculating, collecting and remitting sales tax for ticket events. This saves time and errors on the part of event directors.

All ticket vendors are obligated to provide this service for states that require “Marketplace Facilitators” to collect and remit sales tax. 46 states, plus the District of Columbia, charge sales tax and have marketplace facilitator laws. (DE, MT, NH and OR are the only states that do not collect sales tax).

What is a marketplace facilitator, and what are their responsibilities?

A marketplace facilitator, in this case, is the ticket vendor/platform that the event uses to sell tickets online.

Under marketplace facilitator laws, the vendor (TicketSignup) is required to remit the sales tax on tickets sold on its platform to the states or jurisdictions imposing the tax.

How does TicketSignup calculate the sales tax on my tickets?

Sales tax is complex. There are actually 9,000 jurisdictions (state, counties, and cities) who collect sales tax, with varying rules across thousands of categories. As an example, events in Phoenix, AZ need to make sales tax calculations for Arizona, Maricopa County and the City of Phoenix. Similarly, North Carolina counties charge sales tax, so a ticket event there needs to pay both the state and the county the appropriate amount of sales tax for their ticket sales.

In addition, there are a number of different taxability categories for events:

- Race/Endurance Event Registration/Admission

- Admissions Other (includes entertainment and amusement)

- Admissions Other (does not include entertainment or amusement)

- Admissions Concerts

- Admissions Theatrical / Cinema

- Admissions / Greens Fees for public courses

- Admissions / Greens Fees for private courses

- Nonprofit Event Admissions

- Merchandise Sales

- Memberships

- Processing Fees

We have put together a Sales Taxability Matrix for public use. Here is a snapshot of what the matrix looks like:

Most states have monthly reporting and remittance requirements. For event producers with more than one event, this can cause additional burdens.

How does TicketSignup pay the state the sales tax that my event owes?

TicketSignup has made large investments in our technology stack to automate the calculation, collection and remittance of sales tax for free to all events who use us for transactions. We use Avalara as our calculation and remittance service to calculate tax on each item within each transaction. There is complete reporting for our customers; this can be useful in the event that you ever get audited, or if you want to see how much we are paying your locality.

Many states require monthly sales tax payments; we send them the amount in sales tax that we collected in that time period on all of our events' behalf.

My organization or event is a nonprofit. We are exempt from sales tax. Why is TicketSignup charging sales tax on our ticket sales?

In most states, nonprofit organizations are exempt from paying sales tax on their purchases. However, if your organization is selling tickets or merchandise on TicketSignup, it is acting as a seller, not a buyer, in the context of sales tax law. In most states, nonprofits are not exempt from charging sales tax on sales to their "customers." However, some states have limited seller's exemptions, which are exemptions for charging sales tax that apply to certain types of organizations or to certain types of sales. If you believe your state offers one of these exemptions, you can find it and enable it on the Financial >> Sales Tax >> Setup screen in your event dashboard. See the Exemptions section of this article for more information on exemptions.

Reporting

We provide you with a summary report, as well as detailed transaction level reporting on sales tax. You can find these reports under Financial >> Sales Tax >> Sales Tax Reports.

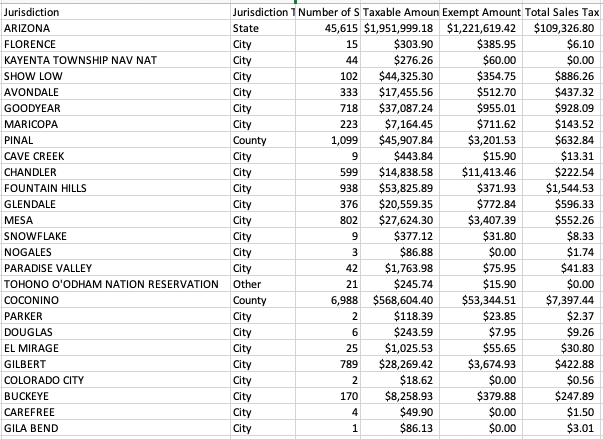

Here is an example of a sales tax summary report:

Here is an example of the sales tax detailed transaction report:

Setup

You do not need to take any action to enable sales tax collection and remittance on TicketSignup. It is automatically enabled for all events, and cannot be removed. If you want to review your sales tax setup, you can go to Financial >> Sales Tax >> Setup in your dashboard.

We try to assign your event and merchandise to the correct category for tax calculation purposes. By default in ticket events, we assign events the Admissions - Other (does not include entertainment or amusement) category. If this is not the best category to use for some or all of your tickets, you can reassign the category under Financial >> Sales Tax >> Taxable Items.

Note: If you are in a state without a statewide marketplace facilitator law, like Alaska, you can still enable sales tax collection on the Financial >> Sales Tax >> Sales Tax Jurisdiction Setup. If you turn this on, we will collect the sales tax and pay it out to you. You will then be responsible for reporting and remitting it to the state.

Exemptions

Nonprofits, government organizations, and some other types of entities may be eligible for exemptions in their state or locality. If this is true of your event, you can find and enable the appropriate exemption on the Financial >> Sales Tax >> Setup page. Read the exemption carefully and make sure that it applies. By enabling an exemption, you are attesting that you believe your event is exempt under state tax law and can prove that in the event of an audit. We recommend consulting with your tax advisor if you are not sure if an exemption applies to you.

You must enable an exemption in order for TicketSignup to stop charging sales tax on your ticket sales. We do not automatically turn off sales tax for nonprofits and have no way of turning it off on a per-event basis.

If you believe that you are an eligible for a sales tax exemption that is not showing in our system, then we need documentation provided by the state or municipality to that effect. You can reach out to us with those details by sending an email to finance@ticketsignup.io or your account manager.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article